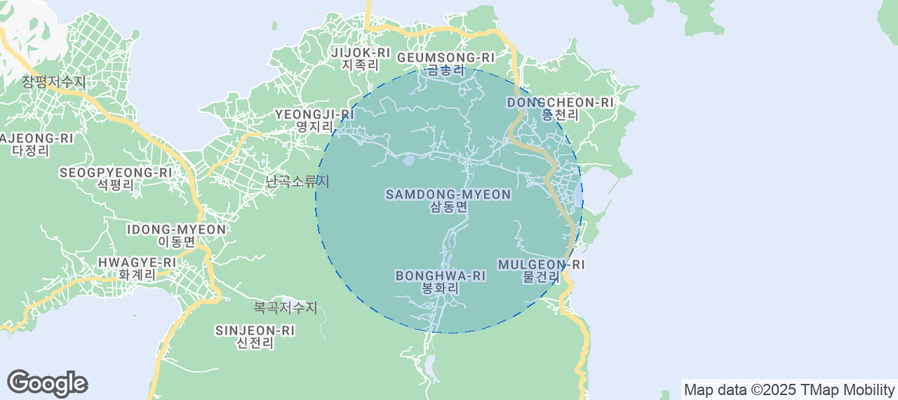

Samdong-myeon Airbnb Market Analysis 2026: Short Term Rental Data & Vacation Rental Statistics in South Gyeongsang, South Korea

Is Airbnb profitable in Samdong-myeon in 2026? Explore comprehensive Airbnb analytics for Samdong-myeon, South Gyeongsang, South Korea to uncover income potential. This 2026 STR market report for Samdong-myeon, based on AirROI data from February 2025 to January 2026, reveals key trends in the niche market of 30 active listings.

Whether you're considering an Airbnb investment in Samdong-myeon, optimizing your existing vacation rental, or exploring rental arbitrage opportunities, understanding the Samdong-myeon Airbnb data is crucial. Navigating the high regulation landscape is key to maximizing your short term rental income potential. Let's dive into the specifics.

Key Samdong-myeon Airbnb Performance Metrics Overview

Monthly Airbnb Revenue Variations & Income Potential in Samdong-myeon (2026)

Understanding the monthly revenue variations for Airbnb listings in Samdong-myeon is key to maximizing your short term rental income potential. Seasonality significantly impacts earnings. Our analysis, based on data from the past 12 months, shows that the peak revenue month for STRs in Samdong-myeon is typically October, while February often presents the lowest earnings, highlighting opportunities for strategic pricing adjustments during shoulder and low seasons. Explore the typical Airbnb income in Samdong-myeon across different performance tiers:

- Best-in-class properties (Top 10%) achieve $1,644+ monthly, often utilizing dynamic pricing and superior guest experiences.

- Strong performing properties (Top 25%) earn $921 or more, indicating effective management and desirable locations/amenities.

- Typical properties (Median) generate around $397 per month, representing the average market performance.

- Entry-level properties (Bottom 25%) see earnings around $184, often with potential for optimization.

Average Monthly Airbnb Earnings Trend in Samdong-myeon

Samdong-myeon Airbnb Occupancy Rate Trends (2026)

Maximize your bookings by understanding the Samdong-myeon STR occupancy trends. Seasonal demand shifts significantly influence how often properties are booked. Typically, Octobersees the highest demand (peak season occupancy), while December experiences the lowest (low season). Effective strategies, like adjusting minimum stays or offering promotions, can boost occupancy during slower periods. Here's how different property tiers perform in Samdong-myeon:

- Best-in-class properties (Top 10%) achieve 45%+ occupancy, indicating high desirability and potentially optimized availability.

- Strong performing properties (Top 25%) maintain 30% or higher occupancy, suggesting good market fit and guest satisfaction.

- Typical properties (Median) have an occupancy rate around 13%.

- Entry-level properties (Bottom 25%) average 7% occupancy, potentially facing higher vacancy.

Average Monthly Occupancy Rate Trend in Samdong-myeon

Average Daily Rate (ADR) Airbnb Trends in Samdong-myeon (2026)

Effective short term rental pricing strategy in Samdong-myeon involves understanding monthly ADR fluctuations. The Average Daily Rate (ADR) for Airbnb in Samdong-myeon typically peaks in August and dips lowest during February. Leveraging Airbnb dynamic pricing tools or strategies based on this seasonality can significantly boost revenue. Here's a look at the typical nightly rates achieved:

- Best-in-class properties (Top 10%) command rates of $153+ per night, often due to premium features or locations.

- Strong performing properties (Top 25%) achieve nightly rates of $125 or more.

- Typical properties (Median) charge around $78 per night.

- Entry-level properties (Bottom 25%) earn around $59 per night.

Average Daily Rate (ADR) Trend by Month in Samdong-myeon

Get Live Samdong-myeon Market Intelligence 👇

Explore Real-time Analytics

Airbnb Seasonality Analysis & Trends in Samdong-myeon (2026)

Peak Season (October, November, August)

- Revenue averages $962 per month

- Occupancy rates average 26.5%

- Daily rates average $105

Shoulder Season

- Revenue averages $676 per month

- Occupancy maintains around 20.1%

- Daily rates hold near $100

Low Season (February, March, December)

- Revenue drops to average $441 per month

- Occupancy decreases to average 14.3%

- Daily rates adjust to average $96

Seasonality Insights for Samdong-myeon

- The Airbnb seasonality in Samdong-myeon shows highly seasonal trends requiring careful strategy. While the sections above show seasonal averages, it's also insightful to look at the extremes:

- During the high season, the absolute peak month showcases Samdong-myeon's highest earning potential, with monthly revenues capable of climbing to $990, occupancy reaching a high of 29.8%, and ADRs peaking at $112.

- Conversely, the slowest single month of the year, typically falling within the low season, marks the market's lowest point. In this month, revenue might dip to $429, occupancy could drop to 13.1%, and ADRs may adjust down to $94.

- Understanding both the seasonal averages and these monthly peaks and troughs in revenue, occupancy, and ADR is crucial for maximizing your Airbnb profit potential in Samdong-myeon.

Seasonal Strategies for Maximizing Profit

- Peak Season: Maximize revenue through premium pricing and potentially longer minimum stays. Ensure high availability.

- Low Season: Offer competitive pricing, special promotions (e.g., extended stay discounts), and flexible cancellation policies. Target off-season travelers like remote workers or budget-conscious guests.

- Shoulder Seasons: Implement dynamic pricing that balances peak and low rates. Target weekend travelers or specific events. Offer slightly more flexible terms than peak season.

- Regularly analyze your own performance against these Samdong-myeon seasonality benchmarks and adjust your pricing and availability strategy accordingly.

Best Areas for Airbnb Investment in Samdong-myeon (2026)

Exploring the top neighborhoods for short-term rentals in Samdong-myeon? This section highlights key areas, outlining why they are attractive for hosts and guests, along with notable local attractions. Consider these locations based on your target guest profile and investment strategy.

| Neighborhood / Area | Why Host Here? (Target Guests & Appeal) | Key Attractions & Landmarks |

|---|---|---|

| Gyeongju | A historical city known as the 'museum without walls' for its UNESCO World Heritage Sites. It attracts tourists interested in cultural heritage and ancient history, making it an ideal spot for Airbnb. | Bulguksa Temple, Seokguram Grotto, Gyeongju National Museum, Anapji Pond, Cheomseongdae Observatory, Daereungwon Ancient Tomb Complex |

| Ulsan | As a major industrial city with beautiful coastlines, Ulsan offers unique attractions for both business travelers and leisure seekers. It's close to natural beauty and has modern amenities. | Ulsan Grand Park, Daewangam Park, Jinha Beach, Taean Beach, Ulsan Museum, Seoknamsa Temple |

| Busan | A dynamic port city known for its beaches, mountains, and temples. Popular with tourist for its vibrant culture, food, and coastal activities, making it a lucrative Airbnb location. | Haeundae Beach, Gwangalli Beach, Gamcheon Culture Village, Jagalchi Fish Market, Busan Tower, Beomeosa Temple |

| Tongyeong | Known as the 'Naples of Korea', Tongyeong is famous for its beautiful islands, fresh seafood, and cultural festivals. It is a scenic destination ideal for Airbnb. | Dongpirang Mural Village, Turtle Island, Korea Maritime and Ocean University, Hallyeohaesang National Park, Tongyeong Live Fish Market |

| Sacheon | Sacheon has a strong aerospace industry and beautiful natural scenery. It's suitable for business travelers, with unique local attractions to explore. | Sacheon Aerospace Museum, Korean War Memorials, Sacheon Ocean Park, Sacheon City Hall Park, Cheongna Hill |

| Miryang | A city rich in history and known for its natural beauty, Miryang attracts tourists looking for a quieter experience, with cultural sites and natural attractions nearby. | Miryang Palace, Miryang Greenway, Pyochungsa Temple, Gwanseongbo Fortress, Eoreumgol Valley |

| Changwon | With a mix of urban and natural attractions, Changwon is a growing city that appeals to both leisure and business travelers, making it a solid investment for Airbnb. | Yongji Lake, Changwon Municipal Museum, Gyeongnam Art Museum, Jinhae Gunhangje Festival, Biwon Garden |

| Geoje | Geoje Island is famous for its beautiful ocean views and maritime activities. It's perfect for tourists looking for a relaxing getaway near the sea, enhancing Airbnb potential. | Oedo-Botania, Geoje Shipbuilding Marine Science Museum, Windy Hill, Gujora Beach, Geoje Haegeumgang Island |

Understanding Airbnb License Requirements & STR Laws in Samdong-myeon (2026)

Yes, Samdong-myeon, South Gyeongsang, South Korea enforces high STR regulations. Obtaining a license and ensuring compliance is almost certainly required according to current 2026 STR laws. Always verify the latest short term rental regulations and Airbnb license requirements directly with local government authorities for Samdong-myeon to ensure full compliance before hosting.

(Source: AirROI data, 2026, based on 67% licensed listings)

Top Performing Airbnb Properties in Samdong-myeon (2026)

Benchmark your potential! Explore examples of top-performing Airbnb properties in Samdong-myeonbased on Trailing Twelve Month (TTM) revenue. Analyze their characteristics, revenue, occupancy rate, and ADR to understand what drives success in this market.

Namhae Island; Day/Beautiful house with rafters Private Village Kangsu/Bedroom 2 German Village 5 mi

Entire Place • 2 bedrooms

Namhae Raeye

Entire Place • 2 bedrooms

Room 3 + Living room + Bathroom 2/8 beds/Sunrise/Namhae Sea 1st floor whole/German Village car 2 min

Entire Place • 3 bedrooms

#Namhae Sea View Restaurant/Sunrise/German Village 2 minutes/4 beds/2nd floor entire/Haeoreum Room

Entire Place • 1 bedroom

Wonye Art Village Filandia Pension

Entire Place • 3 bedrooms

![[Namhae Hill House] Invites you to a comfortable stay with the best view of the German village of Wo](https://a0.muscache.com/im/pictures/dad444ab-0799-4a98-94d8-edb3e5363724.jpg?im_w=480&im_format=avif)

[Namhae Hill House] Invites you to a comfortable stay with the best view of the German village of Wo

Entire Place • 1 bedroom

Note: Performance varies based on location, size, amenities, seasonality, and management quality. Data reflects the past 12 months.

Top Performing Airbnb Hosts in Samdong-myeon (2026)

Learn from the best! This table showcases top-performing Airbnb hosts in Samdong-myeon based on the number of properties managed and estimated total revenue over the past year. Analyze their scale and performance metrics.

| Host Name | Properties | Grossing Revenue | Stay Reviews | Avg Rating |

|---|---|---|---|---|

| 코코맘 | 3 | $36,602 | 708 | 4.93/5.0 |

| 조은별맘 | 1 | $22,160 | 34 | 4.97/5.0 |

| 희선 | 1 | $20,135 | 24 | 4.96/5.0 |

| Book | 1 | $9,123 | 141 | 4.84/5.0 |

| Ks | 1 | $8,583 | 143 | 4.84/5.0 |

| Onda | 3 | $7,827 | 4 | Not Rated |

| 규채 | 1 | $6,582 | 54 | 4.96/5.0 |

| 혜숙 | 2 | $6,153 | 19 | 4.59/5.0 |

| Dohwi | 1 | $4,909 | 304 | 4.82/5.0 |

| 춘옥 | 3 | $4,584 | 8 | 5.00/5.0 |

Analyzing the strategies of top hosts, such as their property selection, pricing, and guest communication, can offer valuable lessons for optimizing your own Airbnb operations in Samdong-myeon.

Dive Deeper: Advanced Samdong-myeon STR Market Data (2026)

Ready to unlock more insights? AirROI provides access to advanced metrics and comprehensive Airbnb data for Samdong-myeon. Explore detailed analytics beyond this report to refine your investment strategy, optimize pricing, and maximize your vacation rental profits.

Explore Advanced MetricsSamdong-myeon Short-Term Rental Market Composition (2026): Property & Room Types

Room Type Distribution

Property Type Distribution

Market Composition Insights for Samdong-myeon

- The Samdong-myeon Airbnb market composition is heavily skewed towards Entire Home/Apt listings, which make up 70% of the 30 active rentals. This indicates strong guest preference for privacy and space.

- Looking at the property type distribution in Samdong-myeon, House properties are the most common (56.7%), reflecting the local real estate landscape.

- Houses represent a significant 56.7% portion, catering likely to families or larger groups.

- The presence of 36.7% Hotel/Boutique listings indicates integration with traditional hospitality.

- Smaller segments like others, outdoor/unique (combined 6.6%) offer potential for unique stay experiences.

Samdong-myeon Airbnb Room Capacity Analysis (2026): Bedroom Distribution

Distribution of Listings by Number of Bedrooms

Room Capacity Insights for Samdong-myeon

- The dominant room capacity in Samdong-myeon is 1 bedroom listings, making up 46.7% of the market. This suggests a strong demand for properties suitable for couples or solo travelers.

- Together, 1 bedroom and 2 bedrooms properties represent 66.7% of the active Airbnb listings in Samdong-myeon, indicating a high concentration in these sizes.

- Listings with 3+ bedrooms (6.7%) represent a smaller niche, potentially indicating an underserved market for larger group accommodations in Samdong-myeon.

Samdong-myeon Vacation Rental Guest Capacity Trends (2026)

Distribution of Listings by Guest Capacity

Guest Capacity Insights for Samdong-myeon

- The most common guest capacity trend in Samdong-myeon vacation rentals is listings accommodating 4 guests (36.7%). This suggests the primary traveler segment is likely small families or groups.

- Properties designed for 4 guests and 2 guests dominate the Samdong-myeon STR market, accounting for 53.4% of listings.

- 13.3% of properties accommodate 6+ guests, serving the market segment for larger families or group travel in Samdong-myeon.

- On average, properties in Samdong-myeon are equipped to host 3.3 guests.

Samdong-myeon Airbnb Booking Patterns (2026): Available vs. Booked Days

Available Days Distribution

Booked Days Distribution

Booking Pattern Insights for Samdong-myeon

- The most common availability pattern in Samdong-myeon falls within the 271-366 days range, representing 83.3% of listings. This suggests many properties have significant open periods on their calendars.

- Approximately 100.0% of listings show high availability (181+ days open annually), indicating potential for increased bookings or specific owner usage patterns.

- For booked days, the 1-30 days range is most frequent in Samdong-myeon (53.3%), reflecting common guest stay durations or potential owner blocking patterns.

Samdong-myeon Airbnb Minimum Stay Requirements Analysis

Distribution of Listings by Minimum Night Requirement

1 Night

26 listings

86.7% of total

2 Nights

2 listings

6.7% of total

30+ Nights

2 listings

6.7% of total

Key Insights

- The most prevalent minimum stay requirement in Samdong-myeon is 1 Night, adopted by 86.7% of listings. This highlights the market's preference for shorter, flexible bookings.

- A strong majority (93.4%) of the Samdong-myeon Airbnb data shows acceptance of very short stays (1-2 nights), indicating a dynamic, high-turnover market.

Recommendations

- Align with the market by considering a 1 Night minimum stay, as 86.7% of Samdong-myeon hosts use this setting.

- Explore offering discounts for stays of 30+ nights to attract the 6.7% of the market seeking extended stays.

- Adjust minimum nights based on seasonality – potentially shorter during low season and longer during peak demand periods in Samdong-myeon.

Samdong-myeon Airbnb Cancellation Policy Trends Analysis (2026)

Flexible

6 listings

20% of total

Moderate

14 listings

46.7% of total

Firm

7 listings

23.3% of total

Strict

3 listings

10% of total

Cancellation Policy Insights for Samdong-myeon

- The prevailing Airbnb cancellation policy trend in Samdong-myeon is Moderate, used by 46.7% of listings.

- There's a relatively balanced mix between guest-friendly (66.7%) and stricter (33.3%) policies, offering choices for different guest needs.

Recommendations for Hosts

- Consider adopting a Moderate policy to align with the 46.7% market standard in Samdong-myeon.

- Using a Strict policy might deter some guests, as only 10% of listings use it. Evaluate if potential revenue protection outweighs possible lower booking rates.

- Regularly review your cancellation policy against competitors and market demand shifts in Samdong-myeon.

Samdong-myeon STR Booking Lead Time Analysis (2026)

Average Booking Lead Time by Month

Booking Lead Time Insights for Samdong-myeon

- The overall average booking lead time for vacation rentals in Samdong-myeon is 23 days.

- Guests book furthest in advance for stays during October (average 42 days), likely coinciding with peak travel demand or local events.

- The shortest booking windows occur for stays in March (average 9 days), indicating more last-minute travel plans during this time.

- Seasonally, Fall (28 days avg.) sees the longest lead times, while Winter (18 days avg.) has the shortest, reflecting typical travel planning cycles.

Recommendations for Hosts

- Use the overall average lead time (23 days) as a baseline for your pricing and availability strategy in Samdong-myeon.

- For October stays, consider implementing length-of-stay discounts or slightly higher rates for bookings made less than 42 days out to capitalize on advance planning.

- During March, focus on last-minute booking availability and promotions, as guests book with very short notice (9 days avg.).

- Target marketing efforts for the Fall season well in advance (at least 28 days) to capture early planners.

- Monitor your own booking lead times against these Samdong-myeon averages to identify opportunities for dynamic pricing adjustments.

Popular & Essential Airbnb Amenities in Samdong-myeon (2026)

Amenity Prevalence

Amenity Insights for Samdong-myeon

- Essential amenities in Samdong-myeon that guests expect include: TV, Fire extinguisher, Air conditioning, Kitchen, Wifi, Free parking on premises. Lacking these (any) could significantly impact bookings.

- Popular amenities like Smoke alarm, Dishes and silverware, Heating are common but not universal. Offering these can provide a competitive edge.

Recommendations for Hosts

- Ensure your listing includes all essential amenities for Samdong-myeon: TV, Fire extinguisher, Air conditioning, Kitchen, Wifi, Free parking on premises.

- Prioritize adding missing essentials: Kitchen, Wifi, Free parking on premises.

- Consider adding popular differentiators like Smoke alarm or Dishes and silverware to increase appeal.

- Highlight unique or less common amenities you offer (e.g., hot tub, dedicated workspace, EV charger) in your listing description and photos.

- Regularly check competitor amenities in Samdong-myeon to stay competitive.

Samdong-myeon Airbnb Guest Demographics & Profile Analysis (2026)

Guest Profile Summary for Samdong-myeon

- The typical guest profile for Airbnb in Samdong-myeon consists of primarily domestic travelers (92%), often arriving from nearby Seoul, typically belonging to the Post-2000s (Gen Z/Alpha) group (50%), primarily speaking Korean or English.

- Domestic travelers account for 91.7% of guests.

- Key international markets include South Korea (91.7%) and United States (4.2%).

- Top languages spoken are Korean (52.2%) followed by English (34.8%).

- A significant demographic segment is the Post-2000s (Gen Z/Alpha) group, representing 50% of guests.

Recommendations for Hosts

- Target domestic marketing efforts towards travelers from Seoul and Ulsan.

- Tailor amenities and listing descriptions to appeal to the dominant Post-2000s (Gen Z/Alpha) demographic (e.g., highlight fast WiFi, smart home features, local guides).

- Highlight unique local experiences or amenities relevant to the primary guest profile.

- Consider seasonal promotions aligned with peak travel times for key origin markets.

Nearby Short-Term Rental Market Comparison

How does the Samdong-myeon Airbnb market stack up against its neighbors? Compare key performance metrics like average monthly revenue, ADR, and occupancy rates in surrounding areas to understand the broader regional STR landscape.

| Market | Active Properties | Monthly Revenue | Daily Rate | Avg. Occupancy |

|---|---|---|---|---|

| Sasebo | 29 | $1,859 | $224.30 | 31% |

| Suyeong-gu | 10 | $1,695 | $185.60 | 47% |

| Tsushima | 29 | $1,578 | $120.60 | 48% |

| Hwayang-eup | 30 | $1,326 | $180.87 | 26% |

| Iki | 20 | $1,320 | $226.95 | 24% |

| Karatsu | 30 | $1,216 | $129.02 | 33% |

| Busan | 4,887 | $1,165 | $105.29 | 44% |

| Gui-myeon | 11 | $1,124 | $173.21 | 24% |

| Gyeongju-si | 1,365 | $1,049 | $131.98 | 31% |

| Hakdong-ri | 22 | $1,023 | $173.05 | 27% |